change in net working capital as a percentage of change in sales

The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow.

Change In Working Capital Video Tutorial W Excel Download

In this case the change is positive or the current working capital is more than the last year.

. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. Including all cash located in the Subject Equipment as reflected in the full service change fund less b the Net Book Value of the current liabilities of the Business listed on Section B-2 of the Disclosure Schedule in each case as of the Sellers last accounting day. First each component of working capital as a percentage of sales is calculated.

Now lets break it down and identify the values of different variables in the problem. So a positive change in net working capital is cash outflow. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this.

Heres a couple examples. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042. Current Operating Assets 50mm AR 25mm Inventory 75mm.

1 NWC as a of sales 2 change in NWC as of CHANGE in revenue. A business has current assets totaling 150000 and current liabilities totaling 100000. Now changes in net working capital are 3000 10000 Less 7000.

For year 2020 the net working capital is 10000 20000 Less 10000. Compare the ratio against other companies in the same industry for additional. To calculate net sales subtract returns 400 from gross sales 25400.

Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. Working capital as a percent of sales is calculated by dividing working capital by sales. Secondly the coming years sales forecast is.

The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. May 6 2018 - 517pm. Imagine if Exxon borrowed an additional 20 billion in long-term debt boosting the current.

For the year 2019 the net working capital was 7000 15000 Less 8000. Hence there is obviously an assumption that working capital and sales have been accurately stated. Calculation of the Sales to Working Capital Ratio.

So the Net Working Capital of Jack and Co is 80000. In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. Such a trend line is an excellent feedback mechanism for.

Jul 3 2020 - 217am. Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio. A business has current assets totaling 100000 and current liabilities totaling 135000.

Change in Net Working Capital 5000. Companies may over stock or under stock because of expectations of shortage of raw materials. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow.

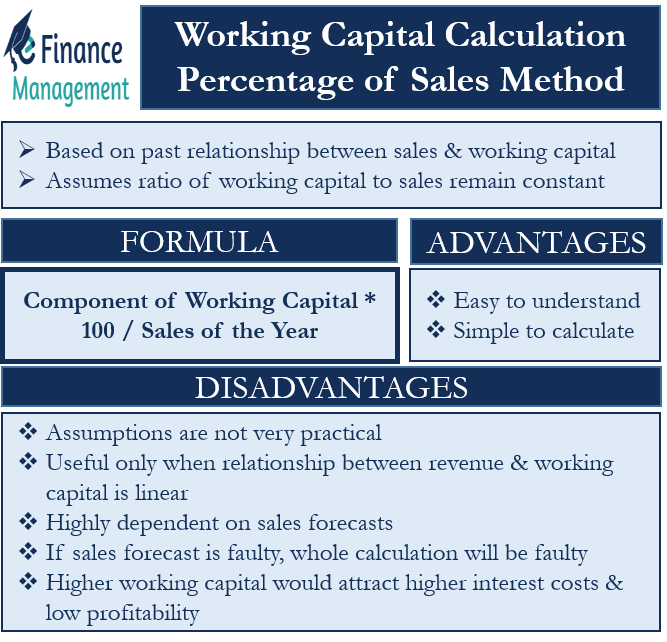

The percentage of sales method is the simplest and easiest way of finding future working capital. Net Working Capital NWC 75mm 60mm 15mm. That means their NWC ratio is 15.

Either change is moving in a favorable direction or do we need to change our. Net Working Capital Formula Current Assets Current Liabilities. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm.

For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. Net Working Capital Ratio Current assets Current Liabilities. I believe either of the following two options is correct.

Public to Private LBO Template. Examples of Working Capital as a Percentage of Sales in a sentence. In-depth Explanation of Working Capital.

The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

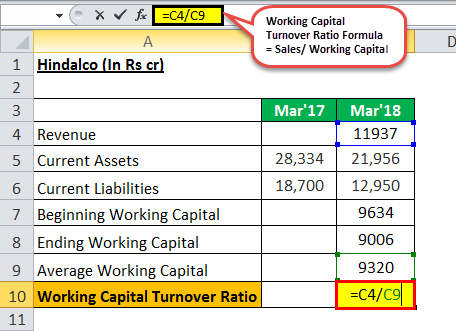

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula And Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Working Capital Turnover Ratio Formula And Calculator Excel Template

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement

Change In Net Working Capital Nwc Formula And Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Calculation Percentage Of Sales Method

Change In Working Capital Video Tutorial W Excel Download

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Changes In Net Working Capital All You Need To Know

Application And Certificate For Payment Template Beautiful Subcontractor Payment Certificate Tem Business Plan Template Free Math Worksheets Statement Template